Prop Firm

What is Prop Trading?

Prop trading, short for proprietary trading, refers to when a financial institution or trading firm trades for its own account rather than on behalf of clients. In prop trading, the firm’s own capital is at risk, and profits generated from successful trades belong to the firm.

Proprietary trading firms employ traders who use various strategies, including technical analysis, quantitative research, and fundamental analysis, to identify profitable trading opportunities in financial markets such as stocks, bonds, commodities, currencies, and derivatives.

Key features of prop trading include:

- Use of Firm Capital: Prop trading firms invest their own capital in the financial markets, rather than trading with client funds.

- Profit Sharing: Traders at proprietary trading firms typically receive a share of the profits generated from their trading activities, often in the form of performance-based bonuses.

- Autonomy and Flexibility: Prop traders often have a high degree of autonomy and flexibility in their trading decisions, allowing them to capitalize on market opportunities efficiently.

- Access to Advanced Technology: Proprietary trading firms invest heavily in advanced trading technology, including high-speed connectivity, algorithmic trading platforms, and data analytics tools, to gain a competitive edge in the markets.

- Risk Management: Prop trading firms implement rigorous risk management protocols to protect their capital and minimize losses. This may include setting risk limits, implementing stop-loss orders, and diversifying trading strategies.

- Regulatory Oversight: Proprietary trading activities are subject to regulatory oversight, depending on the jurisdiction and the type of financial instruments traded. In some cases, proprietary trading activities may be restricted or subject to certain regulatory requirements, particularly in the aftermath of the 2008 financial crisis.

Overall, Proprietary Trading Firms offer opportunities for skilled traders to leverage their expertise and generate significant profits by trading the firm’s capital. However, it also carries risks, including market volatility, liquidity issues, and regulatory constraints, which traders and firms must manage effectively to succeed in the competitive world of proprietary trading.

Prop Firm

Top 4 Proprietary Trading Firms for Day Traders

Proprietary trading firms, also known as prop firms, provide a unique opportunity for day traders to access capital, advanced trading technology, and professional support to enhance their trading endeavors. With a multitude of prop firms available, selecting the right one can significantly impact a trader’s success.

In this article, we’ll explore four of the best proprietary trading firms renowned for their exceptional resources, trader-friendly environments, and track records of success.

- T3 Trading Group: T3 Trading Group stands out as one of the premier prop trading firms, offering traders access to cutting-edge technology, robust risk management tools, and extensive educational resources. With a focus on equities and options trading, T3 provides traders with competitive buying power, low commission rates, and personalized coaching from experienced mentors. The firm’s proprietary trading platform, T3 Live, empowers traders with real-time market data, advanced charting tools, and customizable trading strategies. Additionally, T3 boasts a supportive community of traders, fostering collaboration and camaraderie among members.

- SMB Capital: SMB Capital is renowned for its comprehensive training programs, proprietary trading tools, and collaborative trading environment. Catering to both novice and experienced traders, SMB offers structured education courses, daily webinars, and one-on-one coaching sessions to help traders refine their skills and strategies. Traders at SMB gain access to cutting-edge technology, including proprietary trading software and advanced risk management tools, enabling them to execute trades with precision and confidence. With a focus on equities and options trading, SMB Capital provides traders with ample opportunities to capitalize on market trends and maximize profitability.

- Jane Street: Jane Street is a leading quantitative trading firm known for its innovative approach to market making and algorithmic trading. Specializing in equities, options, futures, and fixed income securities, Jane Street leverages sophisticated trading algorithms and proprietary technology to provide liquidity and execute trades across global financial markets. Traders at Jane Street benefit from competitive compensation packages, state-of-the-art trading infrastructure, and a collaborative team-oriented culture. With a focus on quantitative research and risk management, Jane Street offers traders a dynamic and intellectually stimulating trading environment.

- IMC Trading: IMC Trading is a global market maker and proprietary trading firm specializing in options, futures, and equities trading. With offices in Amsterdam, Chicago, Sydney, and Zug, IMC provides traders with access to diverse financial markets and trading opportunities. Traders at IMC benefit from cutting-edge technology, advanced risk management systems, and extensive training programs designed to enhance trading proficiency. The firm’s collaborative culture fosters innovation and teamwork, enabling traders to thrive in a dynamic and fast-paced trading environment.

Conclusion

Proprietary trading firms offer day traders a unique opportunity to access capital, technology, and resources to elevate their trading endeavors. The four firms highlighted in this article—T3 Trading Group, SMB Capital, Jane Street, and IMC Trading—stand out for their exceptional resources, trader-friendly environments, and commitment to trader success. Whether you’re a novice trader seeking comprehensive training and support or an experienced trader looking to capitalize on advanced trading technology, these prop firms offer the resources and opportunities you need to thrive in today’s dynamic markets.

General1 month ago

General1 month agoMistakes of Beginner Forex Traders – How to avoid common Trader Pitfalls

General4 weeks ago

General4 weeks agoExploring the Best Strategies for Day Trading Success

General4 weeks ago

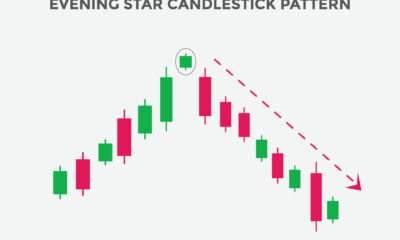

General4 weeks agoHow to master the use of Evening Star Candlestick Pattern for Big Wins

General4 months ago

General4 months agoKey Concepts and Fundamentals for Beginners Diving into Forex Trading

General2 months ago

General2 months agoStrategies and Techniques for Beginners to unlock the secrets of Forex Trading

Prop Firm3 months ago

Prop Firm3 months agoTop 4 Proprietary Trading Firms for Day Traders

General3 months ago

General3 months agoThe eight commandments of Options Trading

General3 months ago

General3 months agoUnveiling the Advantages of Cryptocurrency Trading