General

Tips for Day Trading the Stock Market

Day trading in the stock market involves the swift buying and selling of stocks within the span of a single day. This strategy capitalizes on the minute fluctuations in stock values, aiming to secure quick profits from the volatile market movements.

Typically, day traders refrain from holding positions overnight, opting to enter and exit trades within mere minutes.

A common inquiry among aspiring day traders is whether it’s necessary to remain glued to the computer screen throughout the entire trading day to achieve success. Contrary to popular belief, the answer is no. While there are various factors to consider, the general rule of thumb in day trading is to capitalize on the heightened market activity during the morning hours.

Like all forms of financial investment, day trading carries inherent risks and is considered one of the riskiest trading practices. Stock prices are influenced by unpredictable market behavior, making it challenging to forecast price movements accurately. Day traders execute rapid buy and sell orders in hopes of profiting from short-term fluctuations in stock prices—an approach that sounds simple in theory but proves more challenging in practice.

Limited capital poses a significant constraint for many day traders, as it may restrict their ability to purchase large quantities of stock. However, trading with smaller positions amplifies the risk of potential losses. Furthermore, predicting which stocks will yield profits and which will incur losses remains an uncertain endeavor, even for seasoned traders.

In day trading, emphasis is placed on the number of shares traded rather than their individual value. While losses are an inevitable aspect of day trading, they are typically marginal, even for higher-priced stocks, as daily price fluctuations tend to be moderate.

The day trading arena encompasses a diverse array of stocks and shares, including:

- Growth Stocks: Shares derived from profitable companies experiencing continual value appreciation. These stocks eventually plateau and decline in value, a trend that experienced traders can anticipate.

- Small Caps: Stocks of burgeoning companies exhibiting upward momentum. Despite their affordability, small-cap stocks pose considerable risk to day traders. Opting for large-cap or mid-cap stocks offers greater stability and security.

- Unloved Stocks: Company shares that have under-performed historically. Day traders may purchase these stocks in anticipation of a potential price surge. However, similar to small caps, unloved stocks entail inherent risks.

These examples merely scratch the surface of the stock options available for day trading. Conducting thorough research, understanding market trends, devising a robust strategy, and adhering to a disciplined trading plan are essential prerequisites for success in day trading.

Ultimately, the key to thriving in day trading lies in preparedness. Acquire comprehensive knowledge of the industry, trade opportunistically based on market signals, and execute trades only when market conditions align with a favorable trading opportunity.

General

Exploring the Best Strategies for Day Trading Success

Day trading is a dynamic and fast-paced approach to financial markets, where traders seek to capitalize on short-term price movements to generate profits within a single trading day.

To navigate the complexities of day trading successfully, traders employ a variety of strategies tailored to their individual trading styles, risk tolerance, and market conditions. In this article, we delve into some of the best day trading strategies that can help traders achieve their financial goals and thrive in today’s competitive trading environment.

- Scalping: Scalping is a high-frequency trading strategy characterized by the execution of numerous small trades within a short time frame, typically seconds to minutes. The goal of scalping is to capitalize on small price movements and capture quick profits. Scalpers rely on tight spreads, rapid order execution, and leverage to maximize their trading opportunities. This strategy requires discipline, lightning-fast decision-making, and the ability to react swiftly to market changes.

- Momentum Trading: Momentum trading involves capitalizing on the continuation of existing price trends in the market. Traders identify stocks or other assets that are exhibiting strong upward or downward momentum and enter positions in the direction of the prevailing trend. Momentum traders often use technical indicators such as moving averages, relative strength index (RSI), and volume to confirm the strength of a trend and time their entries and exits accordingly. This strategy requires patience, discipline, and the ability to ride the momentum while managing risk effectively.

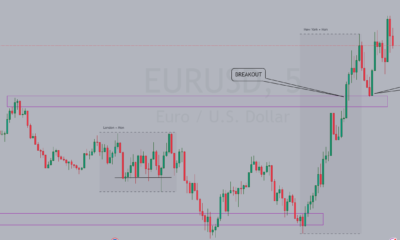

- Breakout Trading: Breakout trading involves entering trades when the price of an asset breaks above or below a significant level of support or resistance. Breakout traders aim to capture the potential for rapid price movements following a breakout from a consolidation phase or a trading range. This strategy relies on identifying key breakout points, setting appropriate stop-loss orders, and managing risk carefully to avoid false breakouts. Breakout trading can be highly profitable in volatile markets but requires careful analysis and risk management.

- Range Trading: Range trading, also known as mean reversion trading, involves buying at the lower end of a price range and selling at the upper end, or vice versa. Traders identify periods of consolidation or sideways movement in the market and look for opportunities to enter positions near support or resistance levels. Range traders use technical indicators such as Bollinger Bands, stochastic oscillators, and pivot points to identify potential trading ranges and time their entries and exits accordingly. This strategy requires patience, discipline, and the ability to capitalize on short-term price reversals within a defined range.

- News Trading: News trading involves capitalizing on market-moving news events and economic data releases to take advantage of short-term price movements. Traders monitor news sources, economic calendars, and market sentiment indicators to identify potential trading opportunities and react quickly to breaking news. News traders may enter positions before or immediately after the release of important news events, aiming to profit from the resulting volatility and market reactions. This strategy requires quick thinking, risk management skills, and the ability to interpret news events accurately.

Conclusion

Day trading offers traders a plethora of strategies to capitalize on short-term price movements and generate profits in the financial markets. Whether employing scalping, momentum trading, breakout trading, range trading, or news trading, successful day traders combine technical analysis, fundamental analysis, and risk management principles to execute their trades with precision and confidence. By mastering the art of day trading and honing their skills over time, traders can unlock the potential for financial independence and achieve their trading goals in today’s dynamic and ever-changing market environment.

General

How to master the use of Evening Star Candlestick Pattern for Big Wins

The art of trading demands a keen eye for patterns that signal potential market reversals or continuations. Among the myriad of candlestick patterns, the Evening Star stands out as a powerful indicator of impending downtrends.

In this article, we unveil the secrets to properly identifying and utilizing the Evening Star candlestick pattern to capitalize on lucrative trading opportunities.

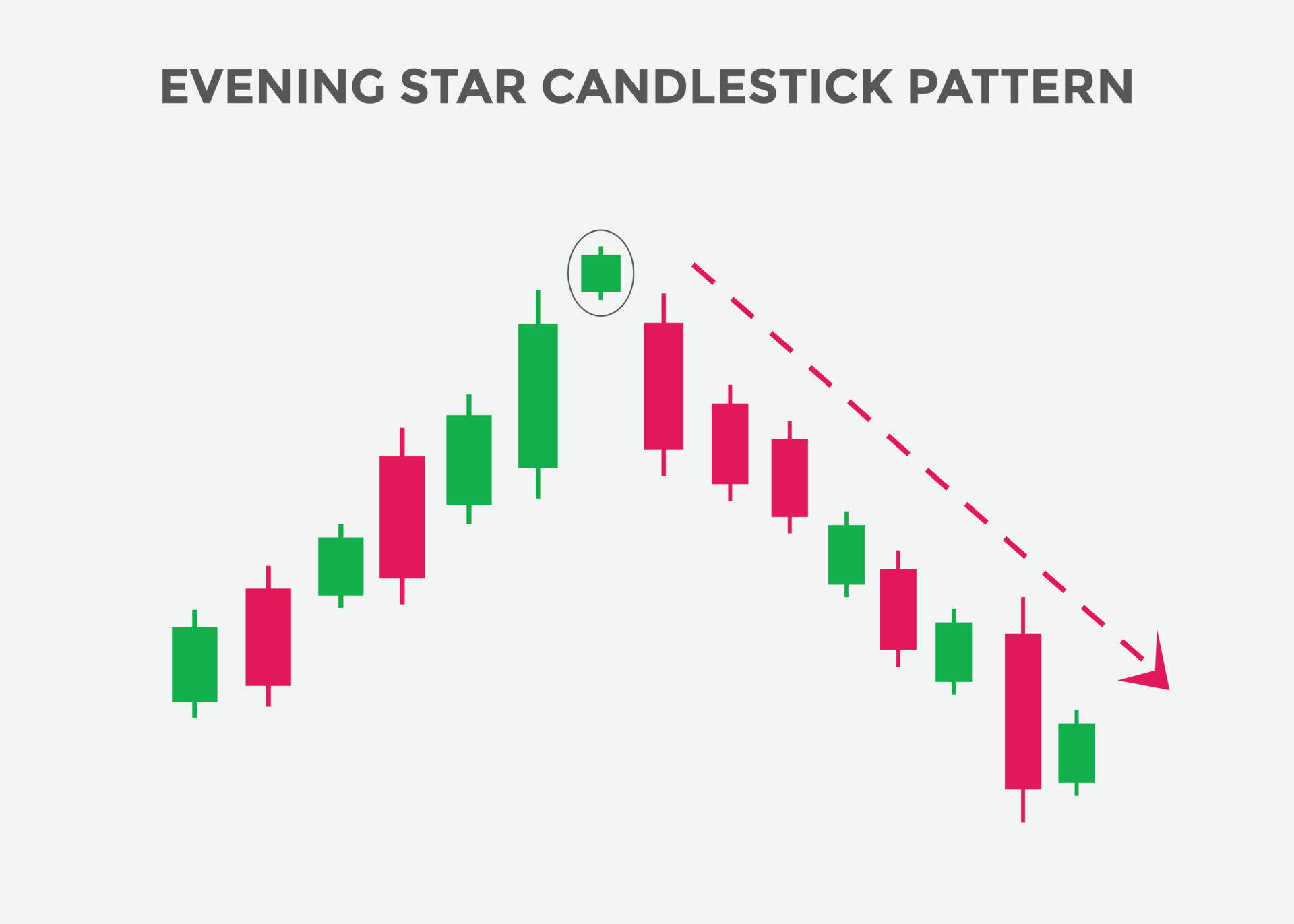

Understanding the Evening Star Candlestick Pattern: The Evening Star pattern consists of three candles and typically occurs at the end of an uptrend, signaling a potential reversal. Here’s how to identify it:

- The first candle is a large bullish candle, indicating bullish momentum.

- The second candle is a small-bodied candle with a small real body or a doji, signaling indecision in the market.

- The third candle is a large bearish candle that closes below the midpoint of the first candle’s body, confirming the reversal.

Proper Usage of the Evening Star Pattern: Now that we’ve grasped the basics, let’s delve into how to effectively use the Evening Star pattern to maximize profits:

- Confirmation is Key: Wait for confirmation before entering a trade. This involves waiting for the third candle to close below the first candle’s midpoint to validate the pattern.

- Combine with Other Indicators: Enhance the reliability of the Evening Star pattern by corroborating it with other technical indicators such as moving averages, RSI, or MACD.

- Context Matters: Consider the broader market context, such as support and resistance levels, trendlines, and fundamental factors, to validate the signal and gauge the strength of the potential reversal.

- Set Stop Loss and Take Profit Levels: Mitigate risk by setting stop-loss orders above the recent swing high and take-profit targets based on risk-reward ratios or key support levels.

- Practice Patience and Discipline: Exercise patience and discipline by waiting for high-quality setups and adhering to your trading plan.

Winning Big with the Evening Star Pattern: By mastering the Evening Star candlestick pattern and integrating it into your trading strategy, you can unlock the potential for substantial gains. Here are some key benefits:

- Early Reversal Signals: The Evening Star pattern provides early warnings of potential trend reversals, allowing traders to enter positions at favorable prices.

- Favorable Risk-Reward Ratio: Properly identifying and trading the Evening Star pattern enables traders to capitalize on favorable risk-reward ratios, minimizing losses and maximizing profits.

- Versatility: The Evening Star pattern is applicable across various timeframes and markets, offering versatility and flexibility in trading strategies.

Conclusion: The Evening Star candlestick pattern is a potent tool in a trader’s arsenal, offering insights into potential market reversals and opportunities for significant profits. By mastering the art of identifying and properly utilizing this pattern, traders can gain an edge in the competitive world of trading and achieve big wins. Remember to combine technical analysis with sound risk management principles and practice diligence and patience to succeed consistently in the markets.

General

Mistakes of Beginner Forex Traders – How to avoid common Trader Pitfalls

Embarking on a journey into Forex trading is an exciting endeavor, but for beginners, navigating the complexities of the Forex market can be challenging. While success is attainable with the right knowledge and approach, many novice traders fall victim to common pitfalls that hinder their progress.

In this article, we’ll explore some of the most prevalent mistakes made by beginner Forex traders and provide insights on how to avoid them.

- Lack of Proper Education: One of the most significant mistakes beginner Forex traders make is diving into trading without adequate education. Without a solid understanding of fundamental concepts such as currency pairs, market analysis, and risk management, traders are ill-equipped to make informed decisions. To avoid this mistake, invest time in learning the basics of Forex trading through reputable educational resources, books, courses, and demo trading platforms.

- Overleveraging: Over-leveraging is a common pitfall that can quickly deplete trading accounts. Beginner traders often fall into the trap of using excessive leverage in an attempt to amplify potential profits. However, high leverage also magnifies losses, putting traders at risk of significant drawdowns or margin calls. To mitigate this risk, beginners should practice responsible leverage usage and only trade with capital they can afford to lose.

- Ignoring Risk Management: Failure to implement proper risk management techniques is another mistake that beginner Forex traders often make. Without effective risk management strategies such as setting stop-loss orders, calculating position sizes, and adhering to risk-reward ratios, traders expose themselves to unnecessary risks. It’s essential to prioritize capital preservation and protect against substantial losses by incorporating risk management into your trading plan.

- Emotional Trading: Emotional trading is a common pitfall that can lead to impulsive decision-making and erratic behavior. Fear, greed, and overconfidence can cloud judgment and result in poor trading outcomes. To overcome emotional trading, beginners should develop a disciplined trading plan with predefined entry and exit criteria, stick to their strategy, and avoid making decisions based on emotions.

- Neglecting Trading Psychology: Neglecting the psychological aspect of trading is a mistake that many beginner traders overlook. Successful trading requires mental discipline, patience, and resilience in the face of adversity. It’s essential to cultivate a positive mindset, manage stress effectively, and maintain confidence in your trading strategy, even during periods of drawdowns or losses.

Conclusion

While Forex trading offers immense potential for profit and financial freedom, it also comes with inherent risks and challenges, especially for beginner traders. By avoiding common pitfalls such as lack of education, overleveraging, ignoring risk management, emotional trading, and neglecting trading psychology, novice traders can improve their chances of success in the forex market. Remember, trading is a journey of continuous learning and self-improvement, and by avoiding these mistakes, beginners can pave the way for long-term trading success.

General1 month ago

General1 month agoMistakes of Beginner Forex Traders – How to avoid common Trader Pitfalls

General4 weeks ago

General4 weeks agoExploring the Best Strategies for Day Trading Success

General4 weeks ago

General4 weeks agoHow to master the use of Evening Star Candlestick Pattern for Big Wins

General4 months ago

General4 months agoKey Concepts and Fundamentals for Beginners Diving into Forex Trading

General2 months ago

General2 months agoStrategies and Techniques for Beginners to unlock the secrets of Forex Trading

Prop Firm3 months ago

Prop Firm3 months agoTop 4 Proprietary Trading Firms for Day Traders

General3 months ago

General3 months agoThe eight commandments of Options Trading

Prop Firm2 months ago

Prop Firm2 months agoWhat is Prop Trading?